LEASED ASSET MANGEMENT MADE SIMPLE

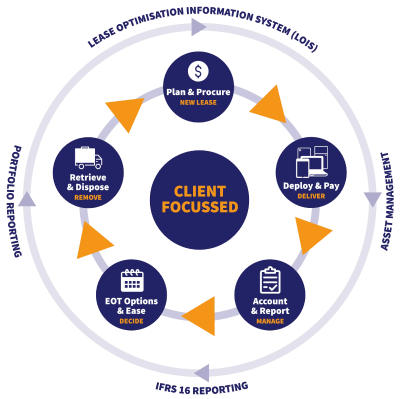

Quadrent’s LOIS is a lease accounting software solution beyond just IFRS 16 compliance, it is a full asset management tool allowing clients to report, manage and account for their assets. The software is supported by our inhouse team of CA qualified accountants and leasing experts to ensure you have the complete solution.

Manage Your Leased Assets in Compliance With IFRS 16

It is vital organisations have an asset management system in place to outline and track all leased assets. For many, this might be simple software or an Excel spreadsheet that highlights key data and manages information.

Previously these were helpful in monitoring asset movements. However, due to IFRS 16, these traditional methods don’t work.

Now, more than ever, organisations require full visibility of data. Leases are no longer simply a cost, but now you must properly account for these as a liability and asset in your balance sheet.

Asset Management Made Simple

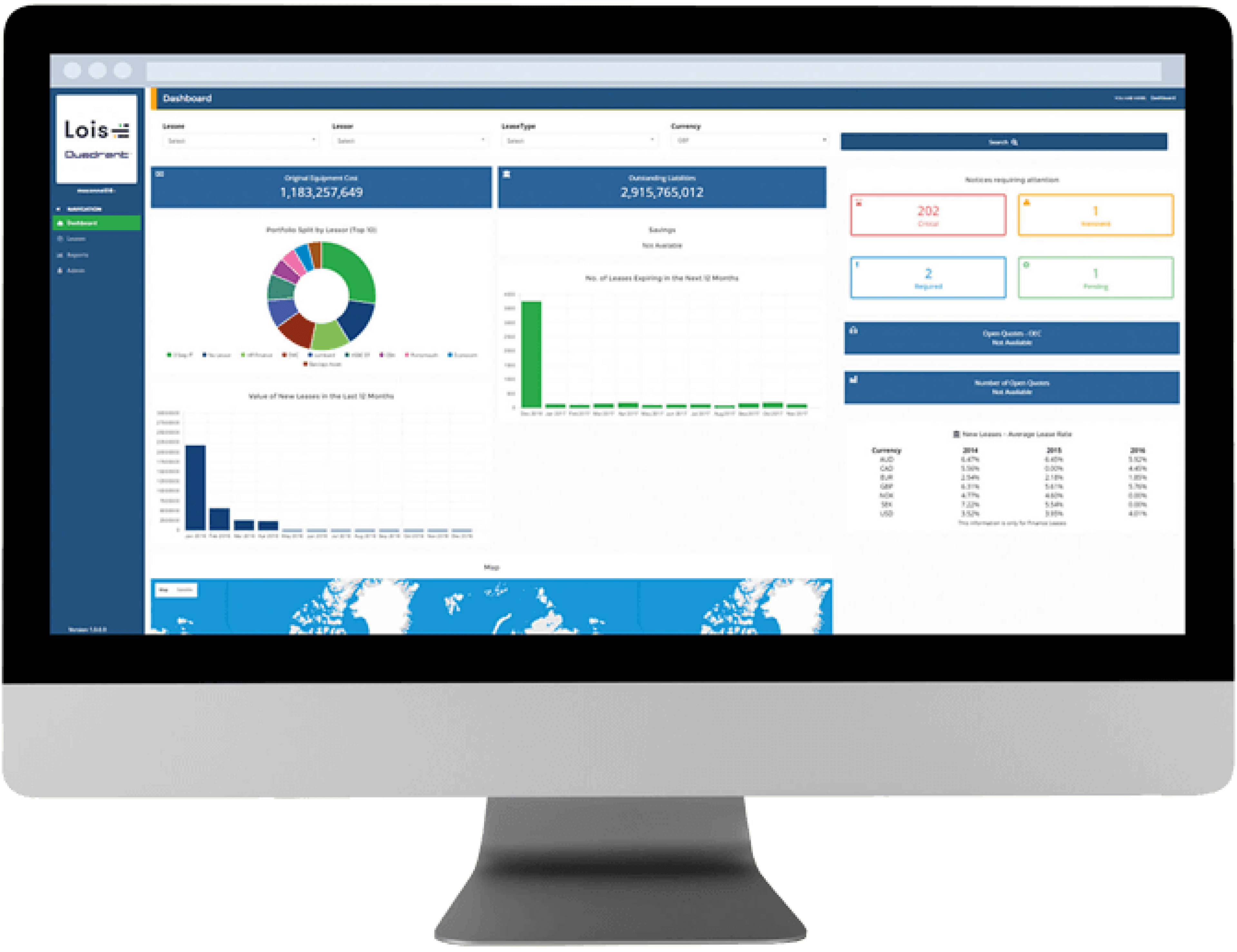

LOIS is a fully automated lease accounting and IFRS 16 compliance software solution with robust, simple and effective processes, including rich portfolio reporting and asset management functionality. This system works in the backend to control and manage all assets as well as contract management. LOIS provides exceptional visibility, the collation of data and actively does the hard work for you. A cost-effective solution to managing your leases.

Additionally, our leasing experts assist with all facets of the asset management lifecycle, which can be broken down into about five key steps.

The Complete Solution for Asset Information and Management Services

Plan and Procure

It’s challenging to plan and procure new assets, especially on a large scale. During the planning and procurement process, Quadrent can assist CIOs and CFOs with these discussions internally to help all stakeholders understand the many benefits leasing will bring to the business. Additionally, we have developed strong relationships with trusted suppliers in the local market and can assist with introductions, if required.

We can establish a credit facility that covers the purchase of the new assets and work with your suppliers to coordinate delivery. Most importantly, we invest in the future value of equipment which gives you a better interest rate compared to traditional debt financing and enables cash flow savings compared to purchasing outright.

Deploy and Pay

We understand that maintaining supplier relationships is important and getting your assets up and running efficiently is key. We will work with partners to ensure assets are deployed to the agreed timeframes and that suppliers are paid on time.

We then manage the procure-to-pay component of the asset lifecycle for you. We will work proactively with your chosen suppliers to ensure on-time payment and assist smooth deployment throughout your technology project. For larger projects, we can align payments to the completion of roll-out milestones.

Account and Report

You need to have transparency of what is on the lease, where it is, how much it is costing and how long the lease has until expiry. By using our lease accounting software solution LOIS, we ensure that all assets are accounted for and reported on in real-time and you are compliant with the IFRS 16 lease accounting standard.

LOIS provides you with a consolidated portfolio view of all leases within the business structure and full IFRS 16 compliance, whether it be a single currency Australasian domiciled entity or a multi-currency global player with disparate systems and decentralised reporting. LOIS is capable of functioning as a stand-alone system or can be integrated into any ERP through a library of APIs and Excel connections.

LOIS offers numerous functions and reporting tools to manage leases and the associated assets from inception to expiration.

EOT Options and Ease

Prior to your lease ending, we will proactively work with you on the best end of term solution, whether that is to return, extend, purchase or upgrade your assets. Your business goals will determine the arrangement we provide.

We don’t like our customers getting surprises, so we give you certainty at all stages of the lease lifecycle.

If you choose to return assets, we are pragmatic, operating a like-for-like returns policy with no changes for reasonable wear and tear or missing peripherals.

Furthermore, if you are a LOIS customer, the software will alert and remind you of upcoming expiries to avoid automatic roll-over from other leasing providers, enabling you to avoid unwanted surprises.

.png)

Retrieve and Dispose

We know that many businesses struggle to afford the time or cost to find, collect, package, remove and wipe the old assets, report on them, and arrange their replacement.

Therefore, at the end (or beginning) of your lease, we can arrange collection, packaging, removal and wiping of old assets using certified providers. This allows you to manage your time and budget, and minimise disruption to staff. The retrieval and the certified environmentally friendly disposal process is a hassle-free and efficient experience for you, so that you’re ready to launch your new project and deploy your newly leased assets.

Additionally, we also understand that at some point, the headache of dealing with old legacy assets needs to be addressed by all businesses. We can assist you by paying you to let us retrieve and sustainably dispose of those old legacy assets hiding in your basement and cupboards.