With the benefit of hindsight three years after implementation, now is a perfect time for businesses to optimise their IFRS 16 process and extract strategic value from lease data. Quadrent recently hosted a webinar prompting companies to take a step back and review their IFRS 16 systems and processes. The webinar was based on the experience of over 70 LOIS lease accounting software implementations to provide knowledge and help businesses identify potential efficiencies in their year-end processes.

You can view the webinar recording here. Keep reading for a summary of what was discussed in the webinar.

It’s time to move beyond a compliance-only approach

When businesses transitioned to IFRS 16, there was no precedent. With big numbers moving to company balance sheets, the focus naturally turned to high-value assets such as property. While many businesses had existing systems to manage property, establishing effective data flow between business units has been an ongoing challenge. As a largely compliance exercise up to this point, many organisations haven’t looked at potential opportunities to optimise their systems for efficiency and strategy moving forward.

Common process inefficiencies plague companies across various industries

.png?width=600&name=_DSCF3066_4000%202%20(1).png)

There are common inefficiencies that businesses across various industries have experienced since the IFRS 16 standards came into effect. From process to modifications, these inefficiencies provide areas for companies to look at when optimising their year-end processes. Common inefficiencies that companies face in the IFRS 16 process are as follows:

- Process vs policy: The key assumptions businesses included in their initial implementation and transition need to be revisited to assess suitability in a business-as-usual environment. Relying on the same process and policies implemented at transition can cause ongoing errors and increase the risk of inaccuracies that have a material impact on the balance sheet.

- Systems vs spreadsheet: Transition was at a point in time where a spreadsheet may have served the purpose of meeting the new standard. However, relying on a spreadsheet moving forward has become problematic for businesses as there’s no audit trail, and it’s difficult to share data across the business effectively. For companies that implemented a system, it may not have the breadth of long-term functionality required, such as robust reporting tools and an accounting ledger.

- Internal boundaries: While the whole business may have been involved in the transition phase, each area of a company may now be taking a siloed approach to lease management, which can make IFRS 16 year-end burdensome. Businesses need to establish systems and processes that keep information flowing between key teams, such as finance, procurement and property.

- Lease identification and asset tracking: Having a holistic approach to lease accounting is critical. Lease identification and asset tracking are key areas where businesses experience poor information flow and inaccuracies. Companies should be looking at ways to address this problem through holistic IFRS 16 systems.

- Modification identification: Original assumptions made when transitioning a few years ago may no longer be valid, especially with macroeconomic changes such as interest rates. Businesses need to make sure assumptions are reviewed and modified accordingly, not just by the finance team but the wider business too.

The above inefficiencies are interconnected, and as businesses have learned over the last few years, an efficient and valuable IFRS 16 process effectively feeds data across the organisation while setting up systems that make continual improvement easier.

What should a ‘good’ IFRS 16 process include?

To establish a ‘good’ IFRS 16 process, businesses need to consider four key factors. By improving the current process that a company uses, the inefficiencies outlined above are also addressed. The areas that should be addressed in a ‘good’ IFRS 16 process are:

- System: For businesses with over 30 leases, an IFRS 16 system is critical. Not only does this ensure compliance, but in finding a fit-for-purpose system based on the system’s accounting functionality and business’s asset portfolio, a company gets the specialist features required for the nuances of IFRS 16. Further, integrations with the organisation's other systems ensure data accuracy and save time on duplicate data entry and reporting.

- Policy: Regularly revisit the business’s IFRS 16 policy with relevant stakeholders across the organisation. This ensures the process remains accurate, especially when it comes to incremental borrowing rates (IBRs) and options such as lease renewals and holdover periods.

- Synergy – teamwork: A stronger system provides an environment for better teamwork as information can flow efficiently between business areas, allowing for problems to be proactively addressed.

- Review: Periodically taking a step back to assess the IFRS 16 process and identify improvements that will benefit employees and the business is an important exercise.

With the above factors addressed, businesses can save time at year-end, enjoy more accurate lease management and reporting, and derive strategic value from IFRS 16 systems.

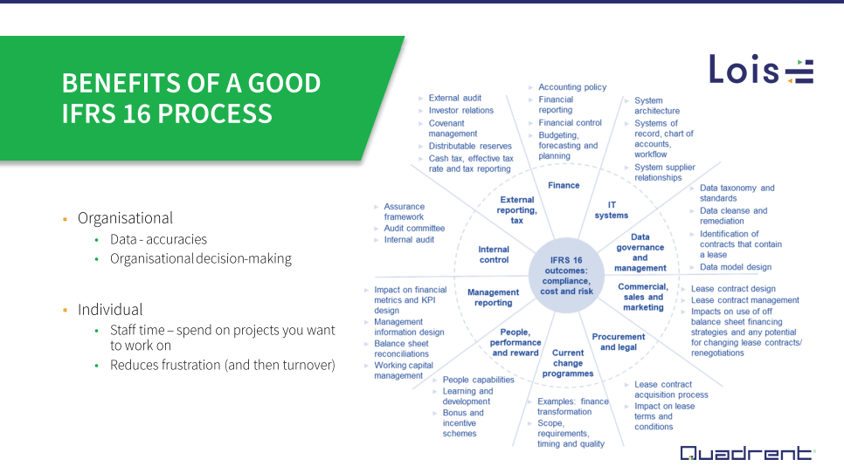

Benefits of a good IFRS 16 process?

Implementing a strong IFRS 16 process delivers benefits across organisations and employees working within these organisations. For those businesses that have implemented a strong system from transition, a wealth of data gives the finance team and other stakeholders valuable insights to make more informed commercial decisions, especially when it comes to the lease portfolio. An example discussed on the webinar was letting a printer lease rollover as the team hadn’t proactively seen or identified the fixed term was coming to an end. With robust data and timely notification of when leases are nearing the end of the fixed term, businesses can proactively decide whether to roll over a lease or find better equipment. For example, in the case of the printer, a company could check the availability of more modern options for the same or a lower price.

Tips and tricks for best practice

A best practice for IFRS 16 must be iterative. Regular policy and process reviews are key to ensuring all business areas are approaching IFRS 16 effectively. Further, a fit-for-purpose system that allows for integration with your current technology and real-time updates and notifications will deliver efficiencies and accuracies that far outweigh the cost of the technology. And by understanding the broader applications of an IFRS 16 system, a business can use the technology to its fullest extent, extracting as much value as possible and using lease accounting and management data for strategic decision making.

Hot topics in IFRS 16

Lease accounting isn’t done in a vacuum. With the world in a constant state of flux and the interest rate cycle at its lowest point in several decades, there are broader macroeconomic factors impacting a business’s leases. Interest rates are expected to rise over the coming months, making leasing an important tool in securing favourable rates while providing the latest technology for employees. Further, giving people the latest technology to do their jobs well can improve job satisfaction, especially as working-from-home has become commonplace.

Similarly, environmental, social and corporate governance (ESG) is still top of mind. Leasing helps companies use technology that’s part of a circular economy to reduce their environmental footprint. It’s an excellent step in helping companies to act now on an issue that will likely require regulatory reporting in the future.

Optimise your IFRS 16 process with Quadrent

IFRS 16 doesn’t need to be a time-intensive year-end task. With the functionality to account for a range of lease types and values, our lease accounting software solution, LOIS, gives businesses a powerful tool to build the systems and processes they need to optimise their lease accounting and management practices.

Quadrent’s team has in-depth leasing knowledge and specialised accounting backgrounds to help you get the most value out of our software throughout the entire asset lifecycle. We work with businesses helping them to accurately manage their leases and improve the data inputs used in calculating your business’s IFRS 16 impacts.

We can help you establish the systems you need to make year-end efficient and effective while giving you the tools to gather a wealth of data to strengthen your commercial decision making. Click here for more information.