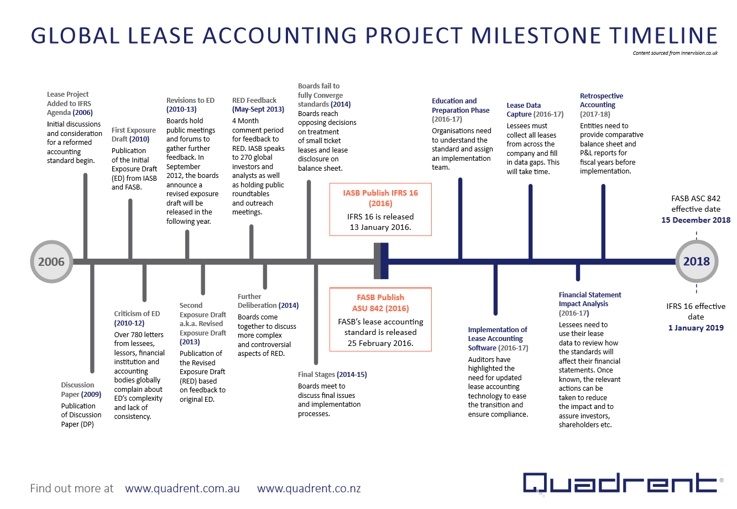

The new global standard for accounting is here and companies are running out of time to comply with the changes, so we have created a simple timeline to help your business to get ready for the IFRS16 changes.

In pursuit of an international standard that provides clearer transparency of companies' lease liabilities, whilst trying to minimise the costs associated with moving to a new standard, now is the time for companies to take the preparatory steps for compliance. We have put together this useful infographic of all the big announcements so far, as well as what organisations should be doing to meet the implementation deadlines.

The project has been a huge undertaking for the IASB and FASB and will potentially be a complex and resource-consuming task for companies implementing either IFRS 16 or FASB ASC 842. Now is the time for businesses to take a look at their current lease portfolio and methods of managing and reporting. In order to comply with the new IFRS and US GAAP lease accounting standards, companies will need to gather the necessary lease data and record and report on their future leases in more detail.

Companies may need to produce comparative balance sheet and P&L reports before the implementation date (depending on which technical application), which requires a high level of historic lease data. This information is not easily accessible for most businesses, as many do not have a standardised lease management procedure in place. Therefore, the deadline for businesses to begin preparations is realistically now.

Businesses are being advised by the leading accountancy firms to begin the process of planning and looking into software solutions immediately to minimise the pressures and costs of compliance. Furthermore, with the delays from most companies in implementation even these electronic solution providers may be caught up in resource issues around the lateness of system implementations.

The easiest and best way for companies to centralise, report and manage their leases is through the use of dedicated lease accounting software. It is vital that lessees have a simple yet unified and logical platform for managing the transition process to either IFRS 16 or ASC 842 to ensure the lease data they collect is comprehensive, accurate and readily available.

Quadrent's lease portfolio management software, LOIS, has advanced lease accounting functionality and is able to run the required outputs of existing and new lease accounting standards. LOIS also creates an "before and after" comparative impact assessment to show how your financial statements will change between the two standards. Lastly, it provides a simple, easy installable, system for all lease information which ensures integrity and will save cost in the long run.

For more information on the upcoming lease accounting standard and how your company can prepare for compliance and savings, download our free 7 steps to compliance guide: