The Current ESG Landscape

Environmental, social and corporate governance (ESG) is becoming an increasingly important part of measuring an organisation’s overall performance. No longer purely financial, key stakeholders, including investors, employees and customers, expect companies to demonstrate their commitment to ESG. Further, the potential for the introduction of universal sustainability reporting standards means that the businesses who are proactive now in reducing their environmental footprint will realise a range of benefits for their organisation now and into the future.

Many companies are taking steps to improve and demonstrate strong ESG practices. Driven by the growing awareness of environmental issues, such as climate change and sustainability, and an appetite for sustainable investing, there are steps that businesses can take to ensure they have the right practices in place without sacrificing financial returns in the long term. Making these changes can help companies prepare for and address the problems that may arise when they don’t have strong ESG practices.

What Problems Will Businesses Without Strong ESG Practices Face?

Businesses may face a range of problems if they don’t have strong ESG practices, including:

Out of date reporting processes: Universal ESG reporting standards are inevitable. Companies that begin addressing ESG issues now, if they haven't already, will be better placed to meet what may be new and more burdensome reporting requirements. Delaying could result in a costly transition process to establish the systems and processes required for compliant reporting all at once. Further, it is often difficult to obtain truly quantified ESG numbers.

Higher interest rates or reduced access to funding: Some financiers are now offering lower rates for companies that demonstrate a positive social and environmental footprint. Similarly, businesses that don’t have strong ESG practices may have challenges accessing finance and investment in the future. Establishing strong practices now can act as a futureproofing and risk management exercise to ensure access to funds in the future.

Excessive waste: Running a business creates waste in all areas, particularly within IT when assets such as laptops, tablets and mobile phones break or become outdated. Disposing of your company’s waste incorrectly can result in the contamination of landfill sites presenting a significant environmental risk for organisations that use large amounts of technology.

Reputational damage: Stakeholders and customers expect companies to evaluate the impact of their actions on society when making decisions. If a business is not seen to take ESG seriously it could have a negative impact on its reputation with a flow on effect to its sales and revenue performance.

Cybersecurity: Using old, outdated assets long past their useful life and the manufacturer’s service support can result in increased cyberattack risks for an organisation, not to mention higher internal IT support costs and operational expenditure. With cybersecurity risks and attack points changing rapidly, organisations need to have strong IT processes in place to avoid sensitive company data being hacked.

Talent attraction and retention: Just as investors and financiers have come to expect demonstrable ESG practices from organisations, so to have current and prospective employees. Without a strong ESG framework, your organisation may miss out on attracting and retaining the best talent in your sector.

Increased risk of shareholder activism: In the event of shareholder activism on issues such as ESG, your company my face increased instability and uncertainty which can impact shareholder value, the company’s reputation and ability to attract further investment in the future.

A Simple Solution for Managing ESG

There is no one size fits all solution for managing ESG as it is such a large area to cover. Therefore, it is key to identify your organisation's specific areas of ESG exposure and be proactive in addressing changes to limit disruption and cost.

However, one of the simplest ways that companies can limit their ESG exposure and reduce their environmental footprint with minimal internal effort is through leasing their assets.

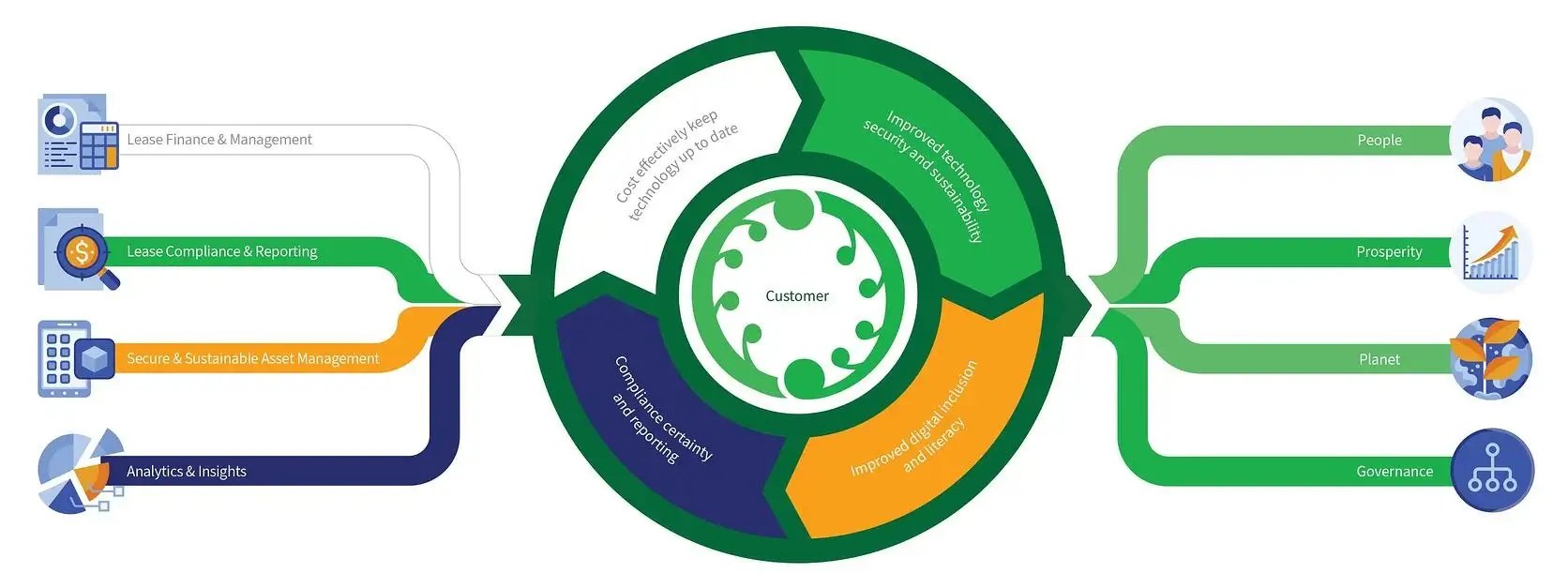

Quadrent’s sustainable technology lifecycle allows you to:

- Access sustainable finance options at competitive interest rates for assets that are green leased.

- Cost-effectively and regularly upgrade (and replace) only the assets that you require.

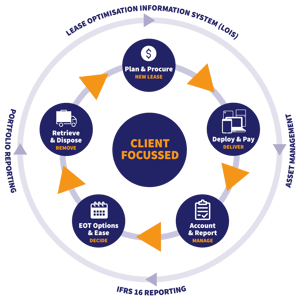

- Report on your ESG outputs through our asset management and IFRS 16 compliance software, LOIS.

- Use accredited sustainable end-of-term options such as e-wasting, recycling, and reselling your old assets.

Discover How We Supported PwC on Their ESG Journey

None of PwC’s 1600 devices were e-wasted, compared to an average of 15% for companies using a CAPEX model.

“Quadrent’s services have delivered benefits that we never anticipated. Their focus on enabling measurable ESG outcomes such as, e-waste reduction, improved data security and employee satisfaction clearly aligns with our ESG journey. To have our technology contribute to both our productivity and transparently demonstrating that PwC is a good corporate citizen, is something that cannot be overlooked.”

Rebecca Thomas, CIO

Realise Efficiencies and Drive Stronger Decision Making

Stakeholders are increasingly asking for better and more reliable information and through the cost-effective upgrade and replacement of assets, along with tools to optimise your lease information, your business can ensure it meets ever heightening ESG standards to ensure the right decision is made. Through leasing your assets and establishing strong systems and processes, your organisation will experience improved:

Efficiency throughout a sustainable asset lifecycle, from decommissioning your current devices (even if these were acquired through CAPEX) to our end-of-lease services.

Flexibility in acquiring assets, ensuring your organisation always has exactly what it needs — no more and no less.

Transparency by implementing a system that accurately records all lease data in a centralised location which drives better decision making and prepares organisations for the adoption of universal ESG reporting standards.

Compliance certainty through implementing a lease optimisation information system such as our SaaS solution, LOIS.

Quadrent’s Sustainable Technology Lifecycle Delivers Wider Benefits Too

By engaging Quadrent for your asset leasing and finance, lease compliance, asset management and reporting, and lease analytics needs, your organisation will not only enjoy the benefits of stronger ESG practices internally, but it has wider benefits to your people and community too.

People: Happier, more motivated and productive employees, as they have access to the latest technology and know that it will be decommissioned securely and sustainably.

Prosperity: A more motivated, productive, and efficient workforce increases the potential for improved customer satisfaction, as well as positive community engagement through demonstrating your business’s strong ESG practices.

Planet: Full ISO certification and reporting into what happens to your old assets, gives you peace of mind that this part of your business is a strong demonstration of responsible corporate citizenship and sustainability.

Governance: With a range of reporting options available to feed into your business's statutory and voluntary reporting requirements resulting in more transparency and reduced corporate governance risks.

Join the Sustainable Circular Economy With Leasing

These changes are opportunities as well as challenges and it is important that every organisation considers how they can capitalise on these changes and create opportunities as they play their part in the country’s overall transformation.

By choosing Quadrent, your assets become part of the sustainable circular economy. It provides your business with capital for the assets you no longer need, along with systems and processes that provide the highest likelihood of reusing or recycling the assets. Not only does this allow your company to maintain sustainable and environmentally conscious practices around your asset lifecycles, but it becomes another way for your organisation to meet today's growing ESG expectations.