Understanding Lease Management

Lease Management: A Guide

Lease management is a requirement faced by every organisation that leases an asset. An operating lease is the rental of an asset from a lessor, but not under terms that transfer ownership of the asset to the lessee. While a finance lease is one in which the lessee assumes substantially all risks and rewards associated with the asset.

An Overview of Lease Management

What Do You Mean by Managing Leases?

It is crucial that those with an operating and finance lease are complying with the IFRS standards, and include these leases on the balance sheet.

This is especially important since the introduction of IFRS 16, which effectively puts all leases, both operating and finance, on the balance sheet as an asset and a liability.

Should I Have an Operating Lease?

An operating lease is especially useful in situations where a business needs to replace its assets on a recurring basis, and so has a need to swap out old assets for new ones at regular intervals.

If your organisation requires the replacement or upgrading of new assets and equipment regularly, an operating lease is a cost-effective solution to ensure this can be done seamlessly.

Should I Have a Finance Lease?

A finance lease is useful in situations whereby a business is looking to lease a specialised asset. The lease may be considered a finance lease if the lease meets the following criteria:

- At the end of the lease period, ownership of the asset is shifted to the lessee, or there is an option to purchase the leased asset.

- The period of the lease covers the majority of the asset's remaining economic life.

- The fair value of the asset or the lessee-guaranteed residual value matches or exceeds the sum of all lease payments.

- The asset is considered to be specialised and there is no alternate use following the lease period.

How Do I Manage These Leases in Compliance With IFRS?

It is vital organisations have lease accounting and management system in place to outline and track all leased assets. For many, this might be a simple software or an Excel spreadsheet system that highlights key data and manages information.

Previously this system was helpful in monitoring asset movements. However, due to IFRS 16, these traditional methods don’t work. Now, more than ever, organisations require full visibility of data. Leases are no longer simply a cost, but now you must properly account for these as a liability and asset in your balance sheet.

Lease Management Made Simple

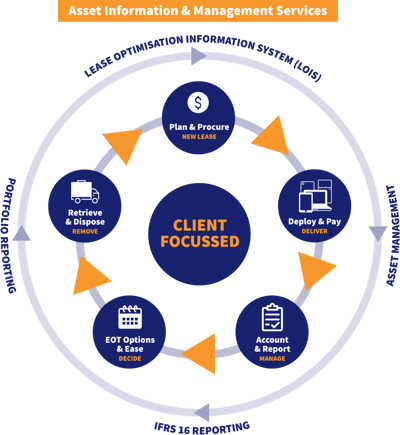

LOIS is a fully automated IFRS 16 lease accounting and compliance software solution with robust, simple and effective processes, including rich portfolio reporting and asset management functionality. The software works in the backend to control and manage all assets as well as contract management. LOIS provides exceptional visibility, the collation of data and actively does the hard work for you. A cost-effective solution to managing your leases.

Discover Our Services

Quadrent provides leasing and lease accounting solutions for large corporates and government organisations helping them to cost-effectively finance and report on their assets. This provides customers with an alternative to the traditional bank lending model and is well suited to assets that have a limited useful life.