Watch a Recording of Our Webinar:

IFRS 16... Important Year-Round Not Just Year End

Deloitte and Quadrent discuss the importance of Incremental Borrowing Rates.

In this CPA Australia hosted webinar with Deloitte Australia we focus on the importance of ensuring your IBR is up-to-date and correct, especially for modifications.

For instance, did you know that the Incremental Borrowing Rate (IBR) you used for your IFRS 16 transition is most likely no longer accurate and your auditor will be focusing on it. This helps to avoid any IFRS 16 compliance issues or balance sheet inaccuracies at year-end and keeps your auditors happy.

The learning outcomes from this webinar are:

- What is an IBR?

- Define the importance of an IBR on lease accounting

- Outline the requirements to update an IBR

- Determine the calculation of an IBR

- Identify what an auditor will be looking for in terms of IBR accuracy

- Discuss best practice of an IBR process

- The commercial considerations of IFRS 16

Fill out the form here to get the recorded version of our webinar and slides.

As this webinar is an activity that increases your knowledge, skills and abilities, it can be recognised as CPD hours.

Facilitator

.png)

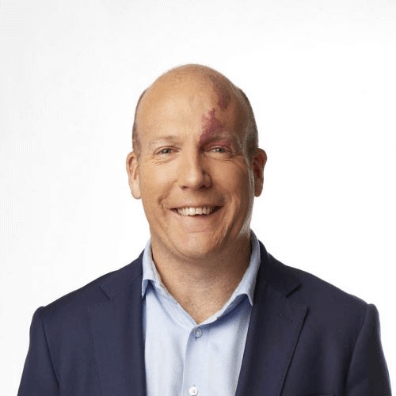

Damon Kennedy

LOIS Client Success Director at Quadrent

Damon has over 20 years’ commercial leasing experience and has been at the forefront of industry innovations that help businesses deal with IFRS 16 compliance – specifically via LOIS (Quadrent’s IFRS 16 lease accounting SaaS solution).

Speakers

Stefan Iggo

CFO at Quadrent

Stefan drives the LOIS Team. His experience in assisting clients across a multitude of industries with their transition to IFRS 16 combined with his background in leasing allows him to have a unique perspective on the market.

Lammert Vos

Partner: Treasury & Capital Markets at Deloitte Australia

As a Partner in Deloitte’s Treasury and Capital Markets Team, Lammert leads the Quantitative Financial Risk Management and Asset Enablement offerings out of Deloitte’s Assurance practice. This includes Deloitte’s online IBR tool, an application that enables Deloitte’s clients to accurately calculate discount rates required to fair value leasing arrangements under IFRS 16.