Environmental, social and corporate governance (ESG) expectations are growing, with transparency and a demonstrable commitment to acting with integrity considered a baseline for any modern company, regardless of size or sector. While the journey to a strong ESG reputation can seem long and confusing, there are actions that companies can take now to simplify the process. Quadrent, in collaboration with PwC and Oxygen Consulting, recently hosted a webinar outlining how companies can start their ESG journey simply and effectively.

View the webinar recording here and keep reading below for a summary of what was discussed in the webinar.

What is ESG?

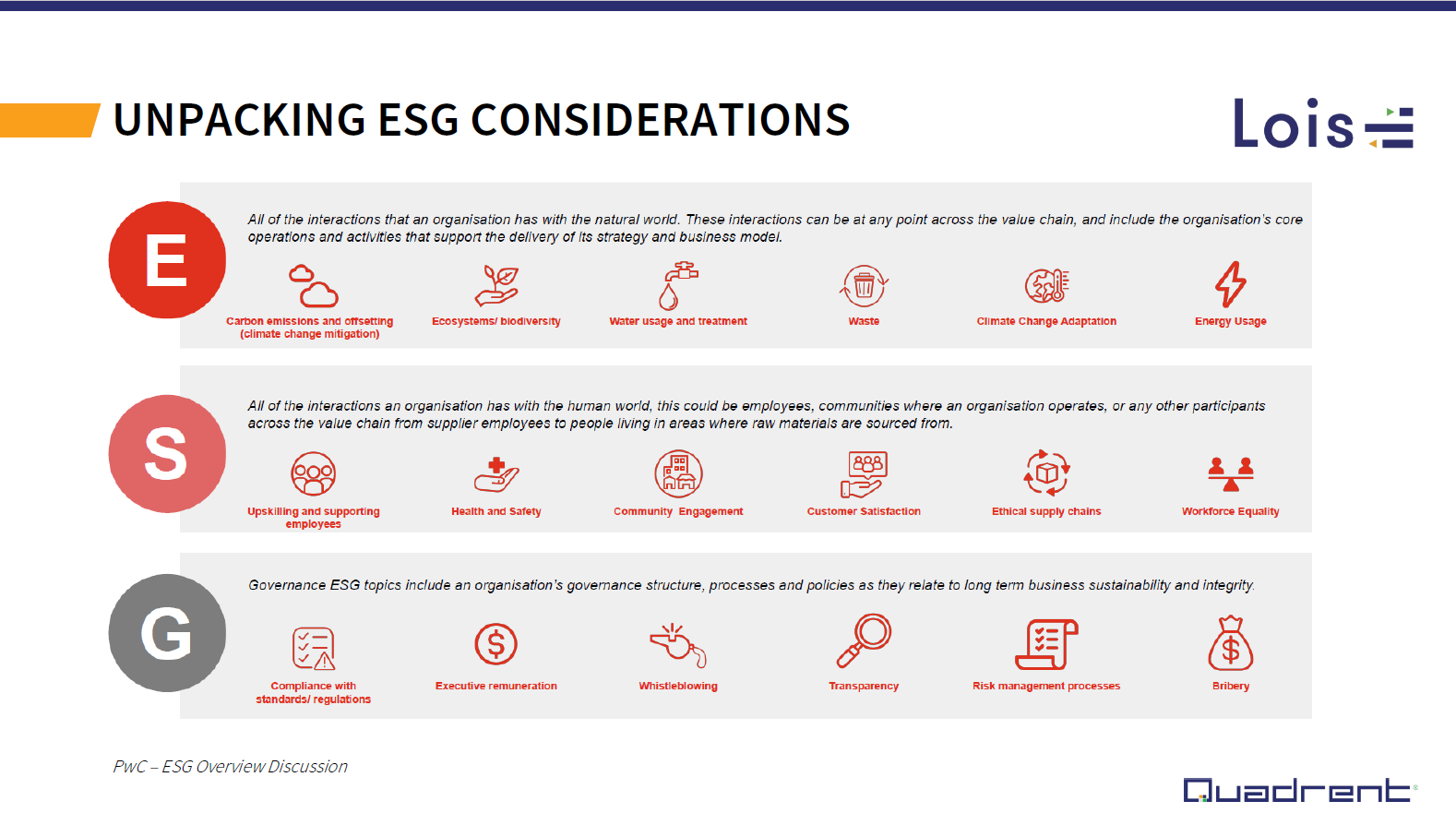

ESG is an approach to evaluating the extent to which a corporation works on behalf of social goals that go beyond the role of a corporation to maximise profits on behalf of the corporation’s shareholders. While the terms ESG, sustainability and climate change are tightly linked, these concepts require different considerations and responses from organisations. Broadly, the driving factors behind ESG outlined in the graphic below demonstrate that issues such as carbon emissions and sustainable practices fall within the environmental factors of ESG considerations. However, it is important not to overlook the impact of your corporate actions on the ‘human world’ and the integrity of the business — the social and governance factors respectively.

Acting on ESG is an investment, not a cost

Acting on ESG is an investment, not a cost

Taking steps to address ESG considerations should be viewed as an investment rather than a cost, given the long-term benefits that companies can realise. These benefits include:

- Attracting and retaining staff: Options such as leasing the most up to date devices can be a powerful factor in fostering stronger employee engagement and a sense of value. This is particularly important given the tight labour market currently.

- Financial benefits: New financial products such as green funding can help companies build a stronger reputation, making it easier to attract finance and investors. Further, strong ESG performance can positively impact company and asset values.

- Enhanced reputation: With a strong reputation for ESG performance, your company can access more opportunities and reap the benefits, such as attracting top talent.

- Risk reduction and resilience: As ESG expectations rise, companies who don’t act could be exposed to greater risk (e.g. compliance and supply chain). Implementing frameworks and change now can greatly minimise the chance of getting caught short.

- Adhering to legislative requirements: While there aren’t currently any mandated ESG reporting requirements, the likelihood that this will eventuate means that companies should proactively address how they can measure their ESG outcomes in a tangible way.

- Innovation: Looking for low-carbon solutions in today’s world provides opportunities for companies to make changes and innovate, which can also open doors to new revenue streams and improved performance.

- Operational efficiencies: Getting the systems and processes in place now to accurately measure ESG performance also delivers efficiencies, particularly in finance and accounting teams who rely on robust data for strong decision making.

What is your organisation’s current ESG performance, and how can you make a difference?

External forces are prompting companies to establish ESG frameworks if they haven’t already. For example, in the case of tendering for new work, the organisation awarding the contract typically needs to see a company’s policies around ESG. Similarly, within companies, internal pressure and expectation comes from current and potential employees who expect that their employer is committed to strong ESG performance.

According to a recent study by Herbert Smith Freehills, just under 30 per cent of companies have a sustainability framework in place, 20 per cent have sustainability-linked financing in place, and 26 per cent of companies publicise their sustainability targets. While this is a UK-based study where ESG responses are typically more mature, it can provide insight into how companies across Australia and New Zealand may respond and when.

For many companies, the understanding exists that ESG is important, but identifying the next steps to address ESG considerations can be a major roadblock. Of those attendees in the webinar from a range of industries and company sizes, half of the attendees were planning their ESG journey and just over ten per cent of organisations already have ESG frameworks in place. Getting to the planning stage of implementing ESG systems and processes is a critical step for companies who haven’t already started, as it provides a roadmap for what can be done immediately and over the longer term.

Creating an ESG framework

The starting point for creating an ESG framework broadly fits into three areas — baselining, reactive responses, and proactive responses.

- Baselining is where companies should identify their exposures and determine the most effective ways to mitigate these. Analysing exposures from a risk and reputation perspective is an effective place to start and makes a meaningful impact. For example, focusing on hygiene and regulatory factors can form the framework for establishing your baseline, such as reducing emissions.

- Reactive responses, similar to baselining, help companies determine the most effective place to start on their ESG journey. Starting with the largest exposures and mitigating these first should be a company’s highest priority.

- Proactive responses allow companies to integrate ESG frameworks into their business model. Moving beyond ensuring your core business operates with strong ESG frameworks, your company can then look to implementing philanthropic and broader initiatives. This is where bottom-up initiatives that are meaningful to your people can be established too.

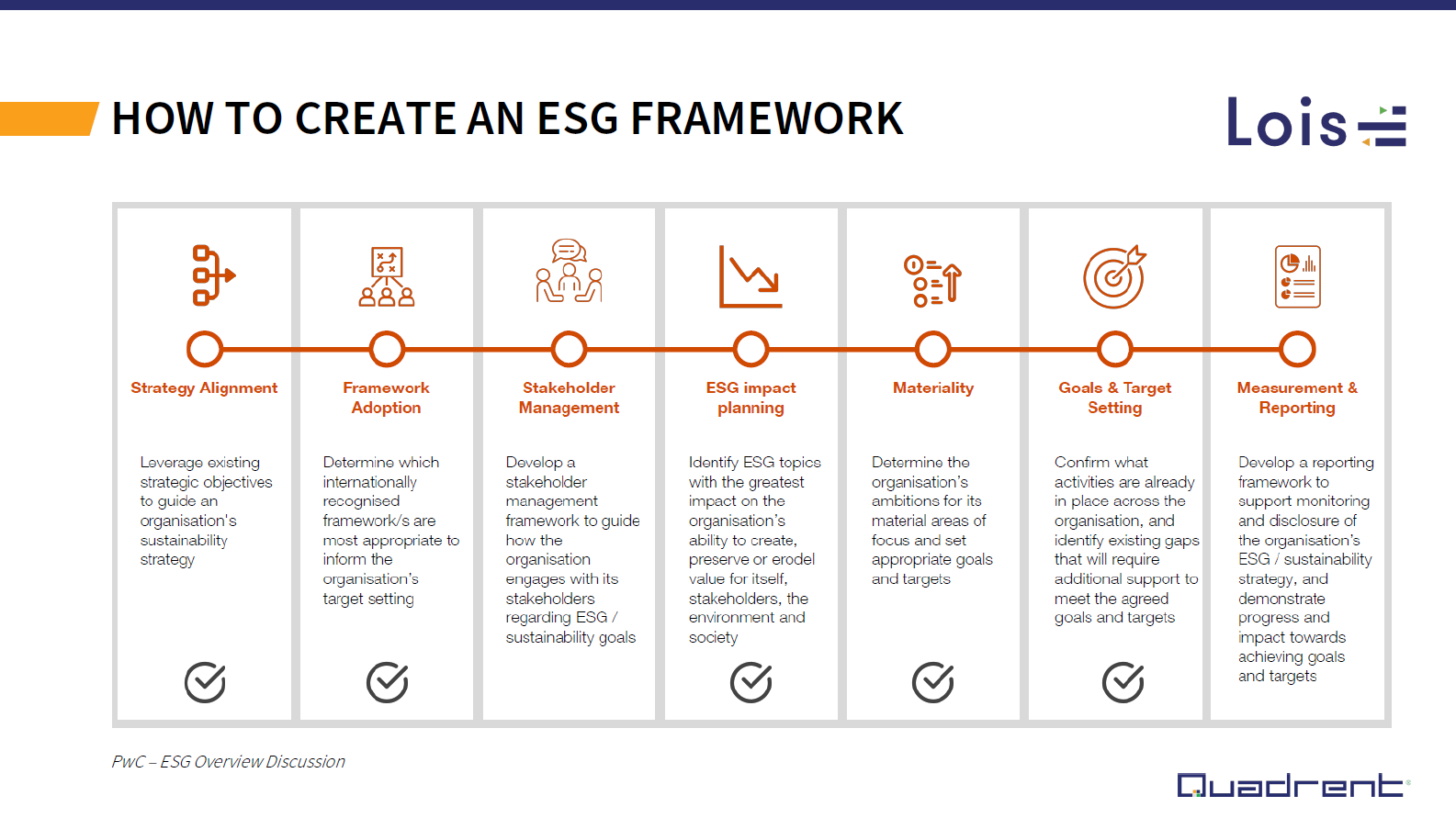

As a long-term move, companies can change their business model or products so that carbon positivity is part of a company’s product and service delivery model. Examples of companies “going the extra distance” to incorporate ESG into their business models include the emergence of investment options such as impact investing funds and companies switching to recycled materials to produce their products. To create an ESG framework, companies should address seven key factors.

Measuring your ESG performance

Measuring your ESG performance

The changing interests and expectations of stakeholders have resulted in significant changes to corporate reporting. Stakeholders demand a strategy that includes quantifiable impacts. They want to understand a company’s:

- reputation

- societal Impact

- navigation of risks

- regulation.

Effective ESG reporting is underpinned by strong governance, measures, and a clear strategy. Implementing systems and processes now that can help your company accurately measure its ESG performance will ensure your company is well-placed to meet future regulatory requirements. In short, if you can’t measure it, you can’t manage it. Starting now, if you haven’t already, is key to proactively establishing your ESG frameworks.

Avoiding “green washing”

In the ESG space, there is a risk that companies can be seen to be “green washing”. A gap between what the company espouses to stand for and how the company acts can cause reputational risk. To mitigate any risk of “green washing”, companies should focus on their core business and act with integrity, only announcing actions that the company is actually taking.

Product innovations that could fit into your ESG strategy today

Starting with materiality helps companies determine where to start on their ESG journey. Ensuring that your company has good governance around the issues you’re seeking to manage and setting expectations that ESG is a marathon, not a sprint, is an effective place to start. Further, understanding what your people and customers care about allows you to identify internal drivers that can form part of your longer-term ESG journey. From here, these drivers can form future changes to your business model and products. Companies that act now will be well-placed to meet growing ESG expectations and move beyond hygiene factors and materiality to capitalise on new opportunities that can eventuate from operating more sustainably.

Make a Simple Start to Your ESG Journey with Quadrent

Australia and New Zealand have two of the highest e-waste rates in the world (around 21 kilograms per person annually), coupled with significant digital equity disparities. Quadrent’s Green Lease is the first ‘assured’ product in Australasia, helping companies access the latest devices while reducing e-waste rates and improving digital equity. Further, Quadrent’s Green Lease provides a simple and measurable way for companies to start their ESG journey.

Quadrent works with businesses helping them to accurately manage their leases, improve IFRS 16 compliance data inputs and proactively manage their ESG risk. With a team that has in-depth leasing knowledge and specialised accounting backgrounds, we’ll help you get the most value out of your assets while addressing increasing ESG requirements.

Start your ESG journey simply and effectively with Quadrent. Click here for more information.