IFRS 16 drove the need for companies to establish new compliance processes, including the calculation of an incremental borrowing rate (IBR). With the standard in place for over three years, there's now an opportunity for companies to begin strategically using leasing data to gain valuable insights and stronger commercial decision making. Quadrent, in collaboration with Deloitte, recently hosted a webinar outlining how companies can gain strategic advantages through proactively reviewing and regularly updating their IBRs.

You can view the webinar recording here. Keep reading for a summary of what was discussed in the webinar.

Background on incremental borrowing rates

The IBR is a borrowing rate that reflects a company's creditworthiness, and at a high level, it's an asset-backed borrowing rate. Calculating a company's IBR can be a complex and difficult process, given the methodology and rate are based on subjective judgement. However, as the rate drives all subsequent calculations throughout IFRS 16 it’s the key variable of a company's right of use assets and liabilities. This means the IBR impacts a company's financial statements, debt covenants and leverage metrics, so it's critical to get it right.

Look beyond IFRS 16 compliance

Auditors review IBRs within a range and assess its materiality to determine if it meets the standard. However, because an IBR isn't observable and justified based on proxy data, it can be difficult to ensure a company is best positioning itself financially. While a company's IBR may be within the reasonable range, it doesn't mean there isn't a better way for companies to get their IBR better positioned and more current, especially in the current macroeconomic environment. Beyond compliance, there's an opportunity within the IBR process to gain strategic advantages.

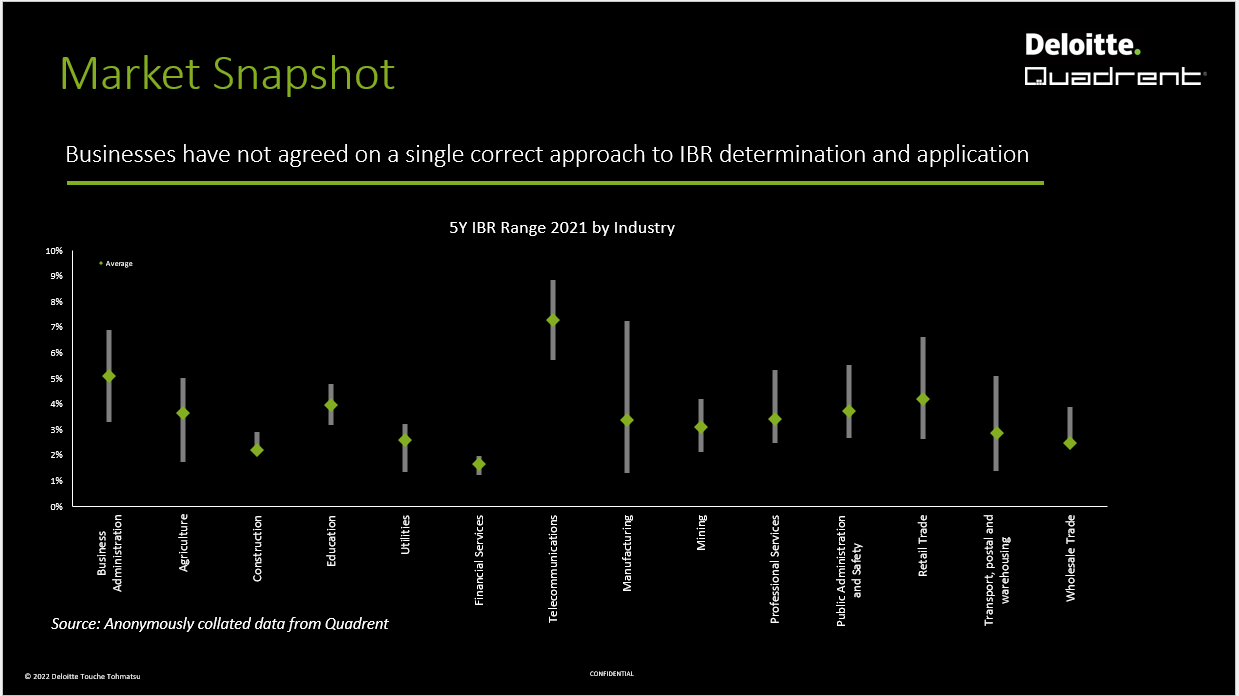

Incremental borrowing rates range widely within industries: Why?

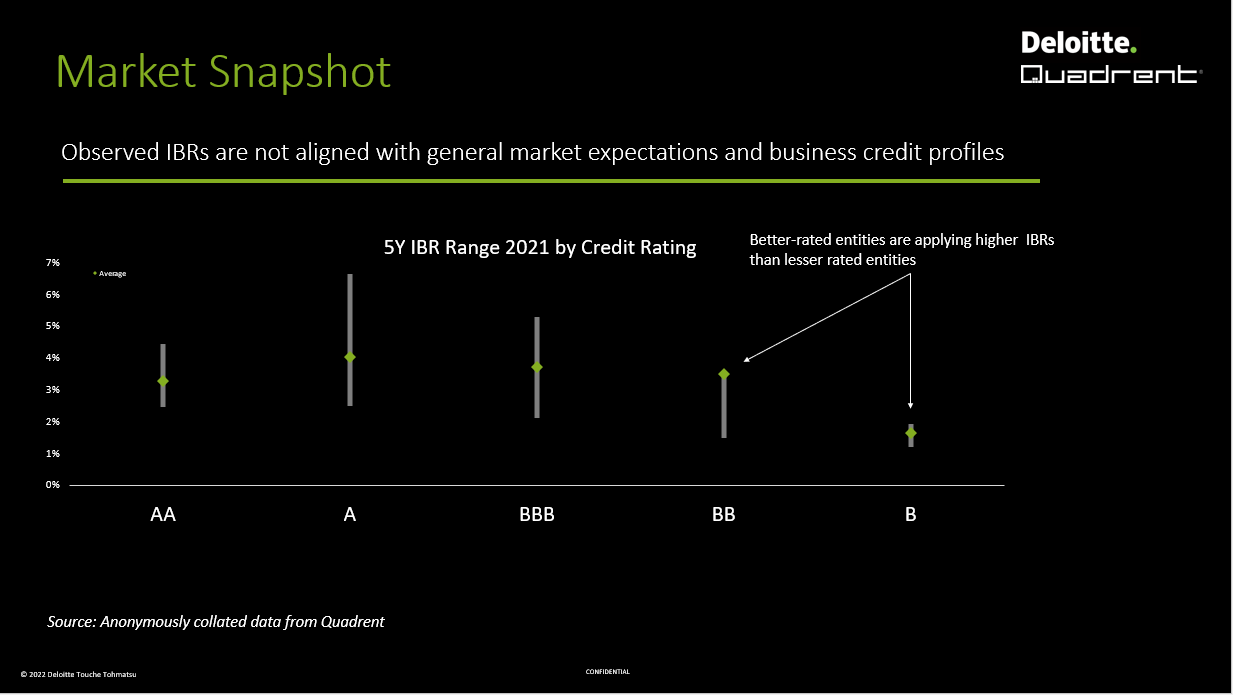

To date, there is no agreed single correct approach to IBR calculation and application. As a result, similar companies within an industry can have IBRs that vary by up to seven per cent, as outlined in the webinar slides. Further, from 2019 to 2021, IBRs barely changed while the global economy was in a constant state of flux. And interestingly, within the same data set, companies with a lower credit rating typically arrived at a lower IBR, at an average of 3 per cent for AA-rated companies and 2 per cent for B-rated companies.

Two key areas of disconnect — static rates and discrepancies between creditworthiness — indicate that many companies have kept their IBR static from their initial IFR 16 transition, despite the potential risks posed by rapid changes in the economy. Some of the reasons companies may have kept their IBRs static in recent years include resourcing requirements to manually review and make modifications, a lack of accepted methodology, and a lack of benchmarking data and automation tools to streamline the process. Establishing an IBR strategy and accessing the tools to review and regularly calculate a more current IBR should be central to a company's lease accounting practices.

The importance of a strategic approach with external stakeholders

A company's IBR impacts many external financial stakeholders across three key areas:

- Financial statements: While auditing occurs within a range, investors and shareholders have a broader industry view and want to see that companies have an IBR comparable to their portfolio or other investment opportunities. In short, it can impact investor appetite if a company looks overleveraged.

- Debt covenants: Creditors, financiers and banks are all impacted by a company's IBR. The proxy for many companies' original IBRs was their debt rating from their bank. Financiers are now working to align their credit assessment processes to include IBRs, given its material impact on a company's balance sheet. Being proactive in engaging with financiers is key as changes to credit frameworks could impact debt covenants.

- Leverage metrics: Rating agencies in the post-IFRS 16 world consider IFRS 16 methodologies within their credit assessments. Using a company's IBR to proactively target an optimal loan to value ratio and credit rating will ensure financial executives are on the front foot.

A company's IBR can work for or against key financial metrics

Many companies still put their IBR adjustments above the management accounts, which means the company isn't operating under the IFRS 16 standards where leasing is a below the line cost, not an operating cost. While it's understandable from an administrative perspective, this needs to change over time so internal stakeholders are working to the global IFRS 16 standards, rather than the IBR simply being an arbitrary metric.

Regardless of whether a company is in the upper or lower end of an IBR range, adjustments to its IBRs can impact key financial metrics, including financial ratios, the income statement, the balance sheet, and the cash flow statement. For example, an increase in the IBR can increase a company's EBIT and current income statement ratio.

Based on Deloitte's analysis of a sample of listed companies, a one per cent increase in the IBR can affect a range of metrics, as outlined below.

|

Metric

|

Lower

|

Upper

|

|

EBIT

|

0.1%↑

|

8.2%↑

|

|

Asset turnover

|

0.2% ↑

|

0.8% ↑

|

|

Lease liability

|

$0.1m ↓

|

$100m ↓

|

|

Leverage

|

0.1% ↓

|

3% ↓

|

Interest rates have a direct impact on incremental borrowing rates

Interest rates are rising, and this has a direct effect on the IBR applied to new leases. Even in an upward trending interest rate environment, there's an opportunity for companies to position balance sheet metrics better. While each balance sheet is unique, performing IBR calculations when entering new leases or making modifications can positively impact many organisations. Further, there are also opportunities in acquisition accounting in an environment with increasing interest rates, as discount rates can significantly impact transactions. The more frequently companies review and adjust their IBR the more companies can maximise the benefits of movements in key financial ratios.

Gain strategic advantages from your incremental borrowing rates with Quadrent and Deloitte

IBR analytics and comparison tools provide companies with the data to make the best strategic judgement, not only for compliance but for each financial area across a company. With these tools, organisations can position themselves to benefit from the rapidly changing economic environment and optimise their balance sheet and profitability metrics with a proactive IBR review and adjustment process. These tools also help companies determine if the rate they're negotiating on financing or leasing arrangements is competitive with the market.

Deloitte's IBR calculator and Quadrent's IBR analytics tool provide the systems and processes they need to calculate and benchmark their IBR within minutes. Not only does this provide efficiencies, but it also reduces the burden of regularly reviewing and updating a company’s IBR.

The Deloitte IBR calculator

Deloitte's IBR calculator can be used to update IBRs more regularly, increase visibility and make stronger commercial decisions in-house. It's a tried and tested tool for companies to review the financial levers available and how these might be used to best position the company financially and meet the objectives of internal and external stakeholders. The IBR calculator generates IBR curves within minutes under various lease and business assumptions. And for those businesses transacting across borders, the calculator can also account for different currencies.

Quadrent IBR analytics tool

Your organisation's IBR can be further optimised through the insights generated by benchmarking analysis. Quadrent's IBR analytics tool is powered by Quadrent's lease accounting software solution, LOIS. The IBR analytics tool provides access to anonymised data that is not publicly available, independent of controlled sources, and correlated to market rates. It is validated against 60,000 actual data points used in leasing books across Australia and New Zealand. This provides the data companies need to leverage the commercial advantages of leasing.

We can help you establish the systems you need to take advantage of the strategic opportunities created through a holistic and efficient IBR review and calculation methodology.