Inflation and macroeconomic volatility continue to challenge companies’ ability to strategically manage cash flow and plan investments in growth initiatives. One of the most effective things companies can do when the prospect of an economic downturn grows is to build their cash reserves and unlock cash flow.

Companies can unlock cash flow in several ways, from cost optimisation to diversifying funding sources through leasing their assets. Importantly, leasing can occur on a range of assets without compromising access to the resources required to deliver products and services. Quadrent, in collaboration with SAR Accounting Advisory, recently hosted a webinar outlining how companies can master leasing strategies to boost cash flow and proactively manage a potential downturn.

View the webinar recording here and keep reading below for a summary of what was discussed.

What is leasing?

A lease product is where a lessee pays the lessor for the use of an asset. It’s fundamentally about transferring the risks of asset ownership. The level of risk transference available depends on the lease structure or type of lease product. Any risks and tolerances driven by the asset class, local market and economic conditions can impact the pricing of the lease.

In broad terms, risk transference is the ability to shift risk to another party. In leasing, lessees are typically looking to reduce the risks inherent in owning an asset. These risks include the cost of ownership, cash flow pressure, and end-of-life tasks to dispose of or refurbish assets correctly.

How leasing works

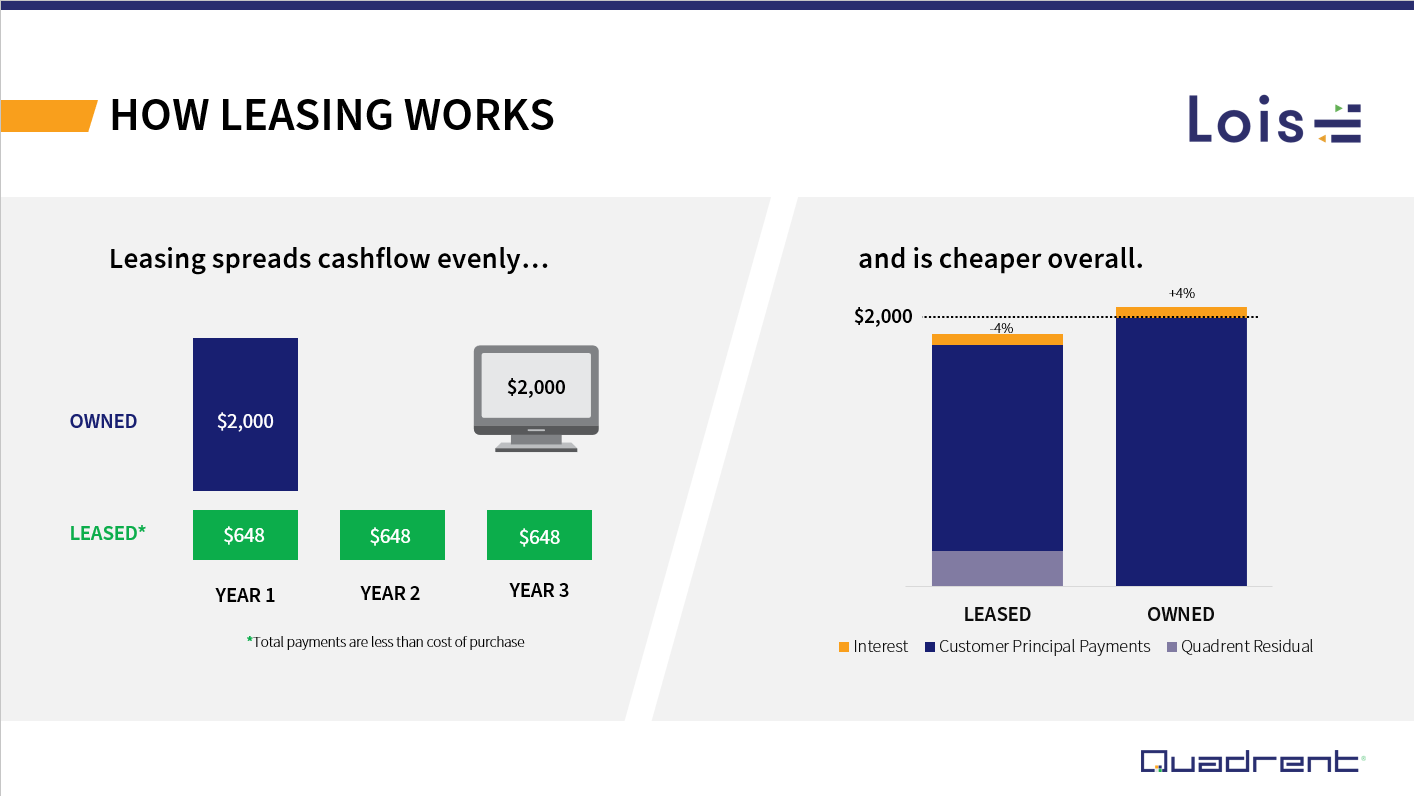

Leasing allows a company to spread its cash flow evenly across the life of an asset. For example, instead of an upfront payment of $2,000 for a computer, the cost can be spread across regular payments for the duration of the lease term. This typically reduces the total cost of ownership for the asset, because the lessor takes a residual position. A residual position is where the lessor invests in the forecast market value of the asset at the end of the lease. This amount is subtracted from the asset’s current value, and the lessee pays the remainder in regular increments. When a residual position is taken, the lessee’s regular payments are reduced while the lessor can maximise the value of the asset when it’s returned through resale or extending the lease term.

Tougher lending conditions require agility and innovation

Among traditional lenders, business lending has tightened over the last two years as inflationary pressures have impacted most industries. As interest rates have continued to rise, any funding secured through a traditional lender can be subject to fluctuations in interest rates, further increasing a company’s financial risk. Leasing aims to provide an alternative to traditional funding channels by smoothing out cash flow, providing more certainty over interest rates by fixing the rate for the lease term, and allowing for flexibility in what assets are in use and when.

How to drive value with leasing

There’s no one-size-fits-all approach to leasing, but there are some key things that companies should consider to ensure leasing is providing value. These considerations include:

- understanding and quantifying the cost of transferring ownership risk

- informing and incentivising the business to make effective decisions from a centralised data source

- exploring the realm of leveraged finance to enhance financial flexibility

- choosing a lessor who will act as a trusted partner throughout the end-to-end leasing process.

How to reduce costs and free up cash immediately

Companies have a range of leasing options available to free up cash flow. For businesses that have already purchased their assets via CAPEX, key options include the sale and leaseback of assets, allowing ownership risks to be transferred to a lessor who manages the leasing process. This provides an injection of cash into the business, and the financing can be used to enable sales focused activities.

For businesses that already have leases in place, investigating whether extending the lease term is suitable for the company and type of asset can be another effective way to reduce costs. As an asset ages, it becomes cheaper to lease it than return it to upgrade to a newer version, so extending the lease term on suitable assets can reduce a business’s expenses.

In some cases, structured finance can be accounted for off balance sheet, depending on the type of finance and what it is funding. This is because, unlike traditional corporate and business finance, structured finance is secured and collateralised differently. For example, a business may access leveraged finance (a type of structured finance) by using the value and future cash flows of an acquired asset to secure the debt. This differs from traditional finance, where specific credit criteria must be met for loan approval.

What is most important to consider when exploring structured finance is how and at what level the risk is transferred. Thorough analysis at the outset will help companies avoid paying a premium to transfer risk for an accounting-driven outcome, such as holding the debt off the company’s balance sheet when it would be cheaper overall to access finance that will be accounted for on the balance sheet.

Proactively manage financial risk with Quadrent’s Asset leasing solution

The ability to transfer and reduce financial risk is critical for companies, especially in an uncertain economic environment. Taking a holistic approach to what assets can be used to unlock cash flow and additional systems a provider can offer to improve a company’s asset management not only drives financial benefits but operational and regulatory efficiencies, too.

Quadrent's asset financing and leasing solutions can help you unlock cash flow and transfer the risk of asset ownership. Click here to contact our team for more information.